QuickBooks Desktop Basic Payroll Customer Service

This gives businesses the option of paying employees weekly, biweekly or monthly, all for the same price. Opting for a plan with accounting software means you’ll also have the ability to track income and expenses, maximize tax deductions, run reports, and send estimates. QuickBooks Plus also includes the ability to manage bills, track inventory and manage 1099 contractors.

We would love to hear which payroll service you decided to go with and why. Customers like that QuickBooks Desktop Basic Payroll is efficient and simple to figure out.

If you get all of those features with Gusto’s most basic plan, what do you get with the more expensive ones? Mainly, you get more HR and administration services, not more payroll services. Most importantly, retained earnings you can approve time-off requests instead of just tracking PTO. And approved PTO is automatically synced to an employee’s pay schedule so you don’t have to make any manual adjustments.

Customer Service: QuickBooks Desktop Payroll Basic vs Enhanced vs Assisted Full Service

The company is also offering three free months for new customers. Wave is among our top picks for best accounting software and best accounting apps because it offers a fantastic range of accounting services while being absolutely free.

Home Depot ESS Employee Portal For Former Employees – MyTHDHR Login

However, customers report that it’s very hard to correct mistakes made on previous paychecks. Customers have also complained that they are still charged monthly fees despite canceling their payroll service.

After conducting extensive research and analysis, we recommend QuickBooks Payrollas our 2019 pick for the best online payroll service for small businesses. For $47.95 per month, you get up to 10 employees’ worth of unlimited pay runs, tax filings and deposits in one state assets = liabilities + equity (with additional states running you extra), and check printing. It’s an easy, quick, mobile-friendly system that doesn’t require a steep learning curve. So depending on how much time and energy inputting payroll takes for you, any of these plans could help out.

To help customers dealing with COVID-19, Gusto has lowered the price of its starter plan, Gusto Core, to just $19 a month for the first six months. Plus, Gusto’sresource guide includes a helpful breakdown https://www.bookstime.com/articles/intuit of changes to state small-business taxes and a particularly useful guide to the new Paycheck Protection Program. Within the last few months, QuickBooks completely revamped its payroll plans.

QuickBooks Desktop Enhanced Payroll Customer Reviews

Once you have employees, you’ll quickly learn how important it is for payroll to be accurate and efficient. Paying your employees, managing benefits, and filing payroll taxes can be difficult and time-consuming. And payroll-related mistakes and delays are potentially costly and damaging to your business. Square doesn’t have a payroll-specific resource page, but it does have a pretty comprehensive roundup of government resources besides the SBA that can offer immediate small-business support. Square also refunded March subscription fees and is waiving all April subscription fees for current Square Payrolls users.

Try QuickBooks Payroll if you want powerful, feature-rich, and secure software that easily integrates with your existing QuickBooks Online account. You are required to pay the withholding taxes and employers match within a few days of the payroll date. If you pay on Friday, your tax deposit is due the following Wednesday. AsLilyCmentioned above, retail stores usually purchase QuickBooks wholesale or in bulk. In turn, it also gives them the opportunity to re-sell the product at a lesser price.

Users report problems configuring payroll on the Mac version of QuickBooks Desktop. All three QuickBooks Desktop Payroll plans include several resources you can use to get help. Similar to QuickBooks Online, all three plans include unlimited live customer support through telephone or chat. Plus, email support is available and support to close out the year is available in all three plans, at no additional charge. QuickBooks Desktop Assisted Full Service Payroll is the easiest to use of the three QuickBooks Desktop payroll options.

- Don’t worry if the DIY method is not for you, payroll services make it easier for small business owners to pay their employees and get back to their core business functions.

- We contacted the company numerous times by phone and email, posing as a business owner interested in payroll services.

- Intuit walks you through each step of adding in basic details about each employee, such as pay rate, federal and state tax information and withholdings, tax exemptions, and benefit deductions.

And if you’re in need of other human resources services, too, Intuit also offers workers’ compensation and compliance assistance. There’s a reason they’ve been voted America’s #1 payroll service, after all. Still, if pricing is your top priority, regardless of your accounting software needs, we can’t recommend Patriot Software highly enough.

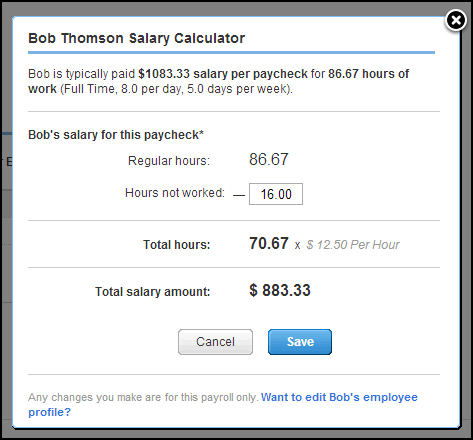

There are additional tabs for taxes and forms, which is where you see all payroll-related tax forms and pay your taxes. You also have an employee tab, where you can add details, such as pay rate and schedule for each worker, and a reports tab where you can access detailed payroll and tax data. A benefit of Intuit is that each of its plans allows unlimited payroll runs for no extra charge.

With self-service plans starting at $19.99 a month and full-service plans starting at $29.99 a month, SurePayroll is one of the cheapest picks on our list. If you go with self service, SurePayroll includes a tax-calculation guarantee, verifying that they’ve accurately assessed your taxes. If you opt for full service, SurePayroll’s https://www.bookstime.com/ 100% tax-filing guarantee means they’ll deal with the IRS if they make a mistake with your payroll taxes—including paying all associated fines. SurePayroll has a thorough guide to all COVID-19 legislation and a jumplink to the Paycheck Protection Program application form, which will take applications from April 3 onward.

All you need to do is enter the employee’s hours and review the payroll data. Customers don’t need to fiddle bookkeeping with the payroll settings or prepare tax forms, as Intuit’s professional accountants do those tasks for you.

Why can’t I view my paycheck on Intuit?

If you don’t see the payroll cloud services option, it means you do not have the latest QuickBooks Desktop maintenance release or the latest payroll updates installed. You need to click on the View My Paycheck checkbox. When you get the prompt, create or confirm a PIN used to send payroll data. Click on Save Changes.

Nevertheless, we have a great lineup of products that you can choose from. If you have enough time, our Payroll Support Teamcan look into your current business needs so that we can choose the best fit for you. Next time you run payroll for employees, try to upload your paycheck information to Intuit when requested. Before employees can sign up and access for ViewMyPaycheck, you need to upload their respective paychecks. It has all the tools business owners need to create paychecks, prepare payroll tax returns, and send payroll tax payments.

Full Service Assisted

The site also offers a handy COVID-19 preparedness toolkit plus tips to protect your company’s data while employees work from home. We doubt ADP’s pricing has changed during the crisis, but the company is putting a special emphasis on its three-month free trial that we heartily recommend new customers take advantage of.

You can reach QuickBooks Payroll representatives by phone, email and live chat between 6 a.m. On the website, you’ll find payroll guides and advice, training videos, details on how to set up the system, and a user community that has answers to questions on all the Intuit products.

While Wave’s payroll software isn’t free, it’s among the cheapest out there while still providing an excellent range of payroll services. All four RUN plans take care of full-service payroll basics like direct deposit, automatic payroll tax filing, and W-2 submissions. Even the cheapest plan, Essential Payroll, includes HR perks like employee onboarding, health care compliance forms, and a regular HR checkup. ADP’s large database covers COVID-19 legislation and changes to employment taxes.

Paychex Flex offers cloud-based payroll and human resources software to small businesses that really need the help but don’t want to deal with full-on HR outsourcing. Each Paychex plan includes new-hire state reporting, automatic payroll tax filing, and even an employee financial wellness program. And while most of the software options we’ve listed include a report intuit payroll or two, Paychex Flex blows everyone else out of the water by offering a whopping 160+ reports with its payroll and HR packages. Unfortunately, SurePayroll charges extra for services most payroll companies include at no extra cost, including accounting software integration. The integration fee is just an extra $4 a month, but it’s an odd thing to charge for.

How can I see my pay stubs online?

You can obtain a copy of your pay stubs by contacting your employer’s human resources or payroll department. Some employers might require employees to submit a formal request to get copies of pay stubs, while others maintain employee pay information in an online database.

Comentarios recientes