Gaps do occur in the forex market, but they are significantly less common than in other markets because forex is traded 24 hours a day, five days a week. Institutional forex trading takes place directly between two parties in an over-the-counter (OTC) market. Meaning there are no centralized exchanges (like the stock market), and the institutional forex market is instead run by a global network of banks and other organizations. Since the market is made by each of the participating banks providing offers andbidsfor a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency.

The foreign exchange market is at best a zero-sum game,meaning that whatever one trader gains, another loses. However, brokerage commissions and other transaction costs are subtracted from the results of all traders, making foreign exchange a negative-sum game. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy. Forex banks, ECNs, and prime brokers offer NDF contracts, which are derivatives that have no real deliver-ability.

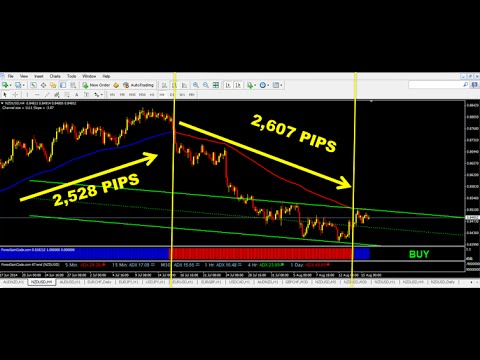

do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. MetaTrader 4, also known as MT4, provides access to a range of markets and hundreds of different financial instruments, including foreign exchange, commodities, etoro CFDs and indices. There have been occasional cases of fraud in the forex market, such as that of Secure Investment, which disappeared with more than $1 billion of investor funds in 2014. Market manipulation of forex rates has also been rampant and has involved some of the biggest players.

Commercial & Investment Banks

In May 2015, for example, four major banks were fined nearly $6 billion for attempting to manipulate exchange rates between 2007 and 2013, bringing total fines levied forex on seven banks to over $10 billion. The forex market is an over-the-counter market that is not centralized and regulated like the stock or futures markets.

NDFs are popular for currencies with restrictions such as the Argentinian peso. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. The mere expectation or rumor of a central bitmex bank foreign exchange intervention might be enough to stabilize the currency. However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. The combined resources of the market can easily overwhelm any central bank.

For example, a central bank may weaken its own currency by creating additional supply during periods of long deflationary trends, which is then used to purchase foreign currency. This effectively weakens the domestic currency, making exports more competitive in the global market.

This system helps create transparency in the market for investors with access to interbank dealing. To accomplish this, a trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange marketsprovide a way tohedge currency risk by fixing a rate at which the transaction will be completed.

Investment managers trade currencies for large accounts such as pension funds, foundations, and endowments. Any action taken by a central bank in the forex market is done to stabilize or increase the competitiveness of that nation’s economy. Central banks (as well as speculators) may engage in currency interventions to make their currencies appreciate or depreciate.

Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolvent, and took FXCM, then the largest retail forex brokerage in the United States, to the verge of bankruptcy. While this could be interpreted to mean that about one in three traders does not lose money trading currencies, that’s not the same as getting rich trading forex. Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern.

This also means that forex trades are not guaranteed by any type of clearing organization, which can give rise to counterparty risk. High degrees of leverage means that trading capital can be depleted very quickly during periods of unusual currency bitmex volatility. These events can come suddenly and move the markets before most individual traders have an opportunity to react. Although currencies can be volatile, violent gyrations like that of the aforementioned Swiss franc are not that common.

- The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account.

- Central banks move forex markets dramatically through monetary policy, exchange regime setting, and, in rare cases, currency intervention.

- The U.S. Commodity Futures Trading Commission (CFTC), which regulates the foreign exchange market in the United States, has noted an increase in the amount of unscrupulous activity in the non-bank foreign exchange industry.

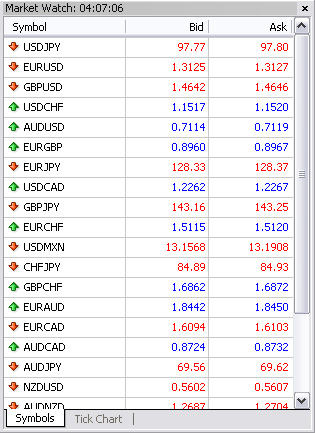

- A pip is the smallest price increment (fraction) tabulated by currency markets to establish the current ask (buying price) and current bid (selling price) of a currency pair such as the Euro/US Dollar (EUR/USD).

- Margin helps to amplify the trading results not just of profits, but of losses as well if a trade goes against you.

- The duration of the trade can be one day, a few days, months or years.

An unwinding of the yen carry trade may cause large Japanese financial institutions and investors with sizable foreign holdings to move money back into Japan as the spread between foreign yields and domestic yields narrows. This strategy, in turn, may result in a broad decrease in global equity prices. The volume of forex trades made by retail investors is extremely low compared to financial institutions and companies. Portfolio managers, pooled funds and hedge funds make up the second-biggest collection of players in the forex market next to banks and central banks.

Questions About Currency Trading

A central bankis responsible for fixing the price of its native currency on forex. This is the exchange rate regime by which its currency will trade in the open market. Exchange rate regimes are divided into floating, fixed and pegged types.

Central banks, which represent their nation’s government, are extremely important players in the forex market. Open market operations and interest rate policies of central banks influence currency rates to a very large extent.

In 1944, the Bretton Woods Accord was signed, allowing currencies to fluctuate within a range of ±1% from the currency’s par exchange rate. As a result, the Bank of Tokyo became the center of foreign exchange by September 1954. etoro Between 1954 and 1959, Japanese law was changed to allow foreign exchange dealings in many more Western currencies. At the end of 1913, nearly half of the world’s foreign exchange was conducted using the pound sterling.

Several scenarios of this nature were seen in the 1992–93 European Exchange Rate Mechanism collapse, and in more recent times in Asia. In developed nations, the state control of the foreign exchange trading ended in 1973 when complete floating and relatively free market conditions of modern times began. Other sources claim that the first time a currency pair was traded by U.S. retail customers was during 1982, with additional currency pairs becoming available by the next year.

The number of foreign banks operating within the boundaries of London increased from 3 in 1860, to 71 in 1913. At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; Britain remained largely uninvolved until 1914. forex Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17; and in 1924, there were 40 firms operating for the purposes of exchange. Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA.

But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains (and losses). Unexpected one time events are not the only risk facing forex traders. Here are seven other reasons why the odds are stacked against the retail trader who wants to get rich trading the forex market. The surprise move from Switzerland’s central bank inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks.

For example, a substantial move that takes the euro from 1.20 to 1.10 versus the U.S. dollar over a week is still bitmex a change of less than 10%. Stocks, on the other hand, can easily trade up or down 20% or more in a single day.

Comentarios recientes